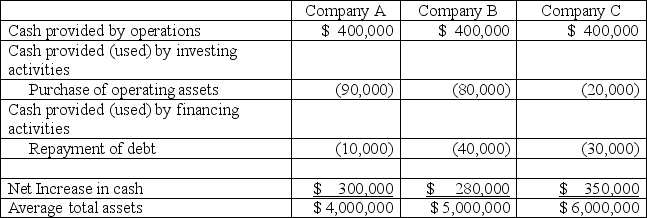

Use the cash flow on total assets ratio to determine which of these three companies is most efficiently using its assets.

Definitions:

Net Present Value

The difference between the present value of cash inflows and outflows over a period of time, used to assess the profitability of investments.

Discount Factor(s)

A multiplicative factor used to calculate the present value of future cash flows by accounting for the time value of money.

Discount Rate

The interest rate used in discounted cash flow analysis to calculate the present value of future cash flows.

Net Present Value

The variance between cash inflows' and outflows' current values during a certain period.

Q22: Match the geometric sequence with its graph

Q30: The effective interest method yields increasing amounts

Q38: Find the inverse of the matrix below,

Q46: A company's transactions with its creditors to

Q53: Simple Simon's balance sheet and income

Q71: The 2011 income statement for Golden

Q126: _ preferred stock gives holders the option

Q142: Internal users of financial information:<br>A)Are not directly

Q159: _ applies analytical tools to general-purpose financial

Q191: A company's only treasury stock transactions for