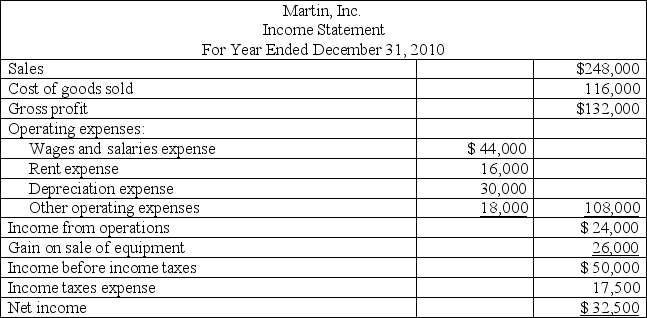

Martin,Inc.'s,income statement is shown below.Based on this income statement and the other information provided,calculate the net cash provided by operations using the indirect method.

Additional information:

Definitions:

Depletion

The allocation of the cost of wearing down or using up natural resources over the period they are extracted or consumed.

Natural Resources

Materials or substances such as minerals, forests, water, and fertile land that occur in nature and can be used for economic gain.

Commercial Substance

A characteristic of a transaction indicating that it will result in a significant change in the economic circumstances of a business.

Future Cash Flows

The amount of money that is expected to be received or paid out by a business in the future.

Q20: Mark and Holly Melton,the owners of

Q33: The entrepreneurs who founded Medsite,Inc.experienced problems as

Q59: Use the matrix capabilities of a graphing

Q85: Total asset turnover reflects a company's ability

Q124: The amount of income earned per share

Q148: The accounting principle that requires significant noncash

Q156: The balance of a note payable at

Q158: The rate of interest that borrowers are

Q161: _ ratios include the price-earnings ratio and

Q190: A company has bonds outstanding with a