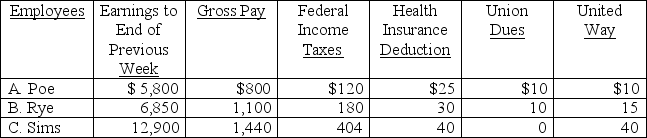

The payroll records of a company provided the following data for the currently weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

World War I

A global conflict that lasted from 1914 to 1918, known as the Great War, characterized by trench warfare and massive casualties, fundamentally changing global politics and society.

Countrywide Network

A comprehensive system spanning an entire country, used in various contexts such as transportation, telecommunications, or retail.

Radio Stations

Broadcast outlets that transmit audio content via radio waves to the public, offering music, news, talk shows, and other programming.

NBC

A major American television network known for producing and broadcasting a wide range of programming, including news, entertainment, and sports.

Q30: A liability does not exist if there

Q31: A company purchased mining property containing 7,350,000

Q46: The accounts receivable turnover is calculated by

Q63: The payroll records of a company provided

Q73: Maryland Company offers a bonus plan to

Q99: A new machine is expected to produce

Q108: A company recently paid $1,500,000 to buy

Q149: During the current year,Quark Company earned $90,000

Q187: A short-term note payable:<br>A)Is a written promise

Q201: A company purchased a mineral deposit for