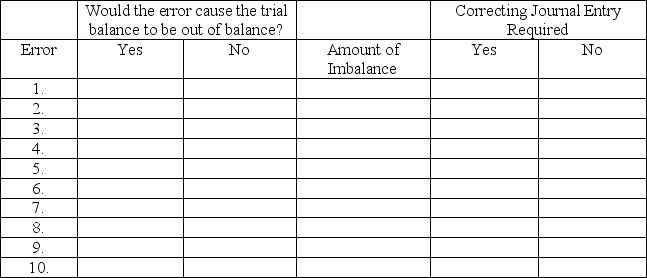

At year-end,Harris Cleaning Service noted the following errors in its trial balance:

It understated the total debits to the Cash account by $500 when computing the account balance.

1.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting

debit was not posted.

2.A cash payment to a creditor for $2,600 was never recorded.

3.The $680 balance of the Prepaid Insurance account was listed in the credit column of the

trial balance.

4.A $24,900 truck purchase for cash was recorded as a $24,090 debit to Vehicles and a

$24,090 credit to Notes Payable.

5.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The

offsetting credit entry was correct.

6.An additional investment of $4,000 by Del Harris was recorded as a debit to Common

Stock and as a credit to Cash.

7.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

8.A revenue account balance of $79,817 was listed on the trial balance as $97,817.

9.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance and whether a correcting journal entry is required.

Definitions:

No-Par Common Stock

A type of common stock that is issued without a par value, meaning its value is not fixed in the corporate charter.

Stated Value

A nominal value assigned to share capital in the company's books, which is not determined by market value but is chosen by the company itself.

Cash Proceeds

The total amount of cash received from transactions, often from the sale of assets or issuance of stock.

Paid-In Capital

Funds received by a company from selling its equity shares to investors, over and above the par or stated value of the shares.

Q20: Given the table below,indicate the impact

Q34: Takita Company had net sales of $500,000

Q56: The balance sheet shows whether or not

Q67: Black Company's unadjusted and adjusted trial balances

Q84: The summary amounts below appear in the

Q109: Revenues are increases in retained earnings from

Q112: On December 31,the balance in the Prepaid

Q162: The dividends account normally has a credit

Q169: The purchases journal is identical under both

Q191: FOB _ means the buyer accepts ownership