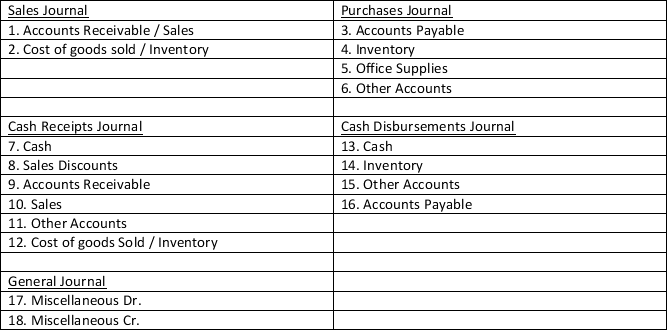

A company records its transactions and events in four special journals and a general journal.The amount columns of these journals are numbered as follows:

Show how each of the following transactions would be recorded in the above set of accounting journals by inserting the number(s)of the columns in which the debit(s)would appear in the column labeled "Debits" below and by inserting the number(s)of the columns in which the credits would appear in the column labeled "Credits" below.

Definitions:

NAFTA

The North American Free Trade Agreement, a treaty between the United States, Canada, and Mexico that eliminated most tariffs and trade barriers between the countries.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than others.

Accounting Services

Professional services that include bookkeeping, audit, tax preparation, financial analysis, and consultancy related to financial management.

Offshoring

The practice of moving a part of a company's operations or business processes to another country to reduce costs or take advantage of favorable conditions.

Q7: Label each stereocenter in the following molecule

Q11: Which electron configuration is correct for the

Q34: _ are investments that are both readily

Q35: _ provide the basic information processed by

Q54: Partners' withdrawals are credited to their separate

Q97: The life of a partnership is _

Q137: A balance column ledger account is:<br>A)An account

Q163: Foreign exchange rates fluctuate due to changing

Q168: Explain the difference between a ledger and

Q168: Presented below is selected financial information