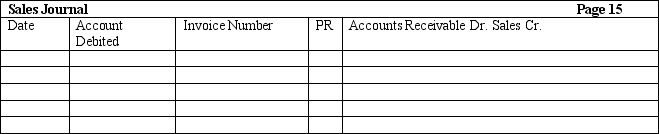

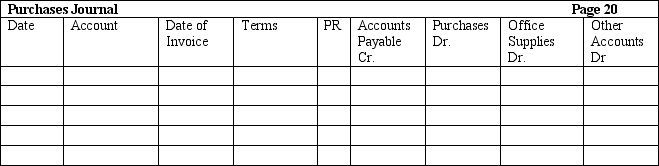

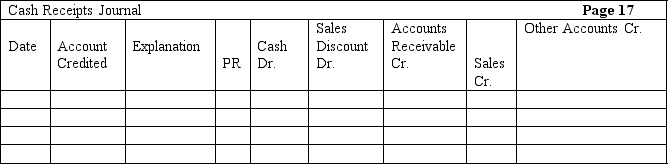

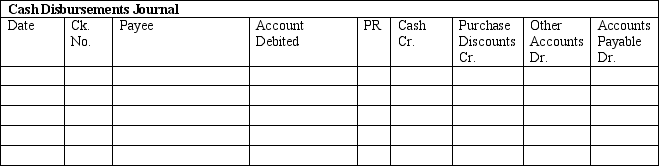

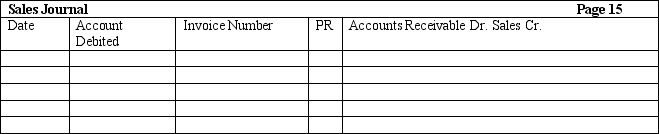

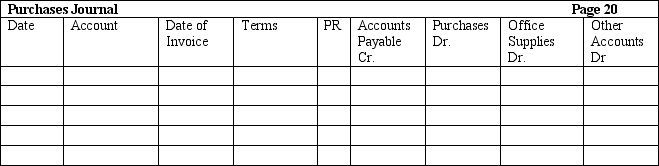

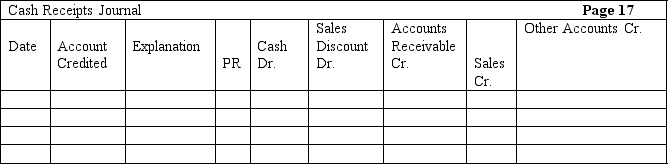

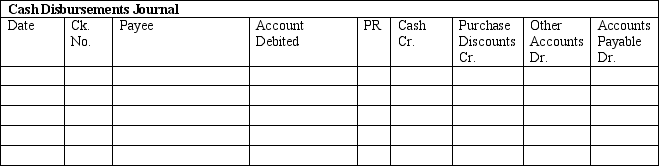

The Woodview Company uses a sales journal,purchases journal,cash receipts journal,cash disbursements journal and general journal.They use the periodic inventory method.The following transactions occurred during the month of December:

Dec. 48101317242731 Sold merchandise on credit for $3,300 to the A&B Co., Invoice No. 313. Purchased merchandise on credit for $1,800 from the Dexter Co., terms 2/10,n/30. Invoice dated December 8. Sold merchandise for $500 cash to RAC Corp., Invoice 314. Collected $3,300 from the A&B Co. for merchandise sold on December 4. Paid amount owed to Dexter Co. from December 8 purchase, Check No. 1011. Sold merchandise on credit for $4,500 to Dunn Corp., Invoice No. 315. Paid $400 cash for monthly rent to Dayton Properties, Check No. 1012. Purchased equipment for $3,055 from Fort Corp., Check No. 1013.

Record these transactions using the journals below.

Definitions:

Point A to Point B

Represents the process or journey from a starting location, situation, or condition to a designated end or goal, often used figuratively.

Skimming Demand

A pricing strategy where a high price is set to "skim" layers of demand from the market sequentially, usually employed during the introduction of a new product.

Penetration Demand

A market strategy focused on increasing market share for an existing product through penetration pricing, advertisement, and sales promotion.

Demand Curve

A graph that relates the quantity sold and price, showing the maximum number of units that will be sold at a given price.