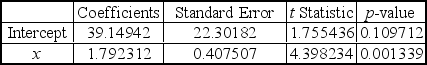

Abby Kratz,a market specialist at the market research firm of Saez,Sikes,and Spitz,is analyzing household budget data collected by her firm.Abby's dependent variable is monthly household expenditures on groceries (in $'s) ,and her independent variable is annual household income (in $1,000's) .Regression analysis of the data yielded the following tables.  11ea8a11_bc89_8e8a_9fff_1d8b9a1c8c20_TB6468_00 Abby's sample size (n) is __________.

11ea8a11_bc89_8e8a_9fff_1d8b9a1c8c20_TB6468_00 Abby's sample size (n) is __________.

A) 8

B) 10

C) 11

D) 20

E) 12s) ,and her independent variable is annual household income (in $1,000's) .Regression analysis of the data yielded the following tables. Abby's sample size (n) is __________. A) 8 B) 10 C) 11 D) 20 E) 12" class="answers-bank-image d-block" rel="preload" > Abby's sample size (n) is __________.

A) 8

B) 10

C) 11

D) 20

E) 12s) ,and her independent variable is annual household income (in $1,000's) .Regression analysis of the data yielded the following tables. Abby's sample size (n) is __________. A) 8 B) 10 C) 11 D) 20 E) 12" class="answers-bank-image d-block" rel="preload" > 11ea8a11_bc89_8e8a_9fff_1d8b9a1c8c20_TB6468_00 Abby's sample size (n) is __________.

Definitions:

Primarily Rental Property

Real estate that is predominantly used for rental to others, rather than as the owner's primary residence.

Schedule E

A form used by the IRS for taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts.

Royalties

Payments made to the owners of intellectual property, such as authors, composers, and inventors, for the rights to use their intellectual property.

Form 1099-MISC

A tax form used to report various types of income other than salaries, such as fees, royalties, and self-employment income.

Q9: If the Year<sub>t</sub> Quarter<sub>q</sub> actual value is

Q11: Use of the chi-square statistic to estimate

Q22: Consider the following null and alternative hypotheses.

Q37: Many "Before and after" types of experiments

Q39: When a statistic calculated from sample data

Q46: A simple regression model resulted in a

Q54: A regression analysis conducted to predict an

Q57: A researcher is conducting a matched?pairs study.She

Q59: Inspecting the attributes of a finished product

Q71: An exponential smoothing technique in which the