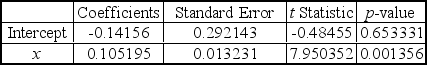

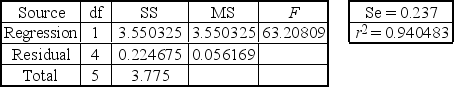

Annie Mikhail,market analyst for a national company specializing in historic city tours,is analyzing the relationship between the sales revenue from historic city tours and the size of the city.She gathers data from six cities in which the tours are offered.Annie's dependent variable is annual sales revenues and her independent variable is the city population.Regression analysis of the data yielded the following tables.

For a city with a population of 500,000,Annie's model predicts annual sales of ________________.

For a city with a population of 500,000,Annie's model predicts annual sales of ________________.

Definitions:

Net Operating Income

A financial metric that calculates the profitability of a business's core operations, excluding the costs and returns of financial activities and one-time events.

Scrap Value

The estimated resale value of an asset at the end of its useful life, which is considered during the depreciation calculation of that asset.

Required Rate of Return

The minimum rate of return on an investment deemed acceptable by an investor, considering the investment's risk.

Internal Rate of Return

A financial metric used to evaluate the profitability of potential investments, calculating the discount rate that makes the net present value of all cash flows equal to zero.

Q2: Data from a randomized block design

Q18: Abby Kratz,a market specialist at the

Q34: Discrete Components,Inc.manufactures a line of electrical

Q35: In conducting the z test of proportions,the

Q35: A human resources analyst is developing a

Q39: A research project was conducted to study

Q60: A researcher believes that a variable

Q64: Control charts are used to examine the

Q80: The Kruskal-Wallis test is to be used

Q87: Using 2011 as the base year,the 2010