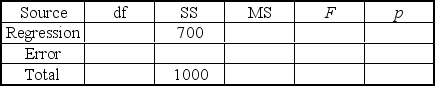

The following ANOVA table is from a multiple regression analysis with n = 35 and four independent variables.  The R2 value is __________.

The R2 value is __________.

Definitions:

Proportional Taxes

A tax system where the tax rate remains constant regardless of the amount on which the tax is imposed, resulting in taxes being proportionate to the income.

Direct Taxes

Taxes paid directly to the government by the individual or organization on whom it is levied, such as income tax or property tax.

Direct Tax

A form of taxation where the burden directly falls on the income or wealth of the individual or entity being taxed, such as income tax or property tax.

Fiscal Year

A one-year period used for financial reporting and budgeting, which does not necessarily align with the calendar year.

Q1: In the Wilcoxon test of the differences

Q11: The sampling distribution of R,the number of

Q14: Maureen McIlvoy,owner and CEO of a

Q26: A simple regression model developed for ten

Q36: A market analyst is developing a regression

Q52: In a simple regression the coefficient of

Q52: Which of the following iterative search procedures

Q63: A multiple regression analysis produced the following

Q65: For a certain data set the regression

Q69: Nonparametric statistical techniques are based on fewer