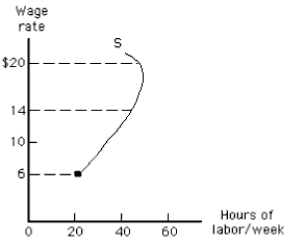

Exhibit 12-2

-In Exhibit 12-2, which of the following is true if the wage rate decreases from $14 to $6 per hour?

Definitions:

Benefits-Received Tax

A taxation principle where taxes are levied on individuals based on the benefits they receive from the government's use of the collected tax.

Vertical Equity

A principle in taxation that proposes taxpayers with a greater ability to pay, such as higher income levels, should pay more in taxes than those with lesser ability to pay.

Horizontal Equity

The principle that individuals with the same income or resources should be treated equally by the tax system.

Tax Deductions

Expenses that can be subtracted from gross income to reduce the amount of income that is subject to income tax.

Q3: The Pat Summerall School of Diction is

Q15: If an economy increases the amount of

Q53: A monopolistically competitive firm<br>A) earns no long-run

Q53: If transaction costs of market exchange are

Q76: Suppose the marginal product of the second

Q83: If a monopolistically competitive firm is in

Q116: Which of the following describes the relationship

Q127: If the annual interest rate is 4

Q150: In order to reduce labor supply,a union

Q197: For firms in an oligopoly to be