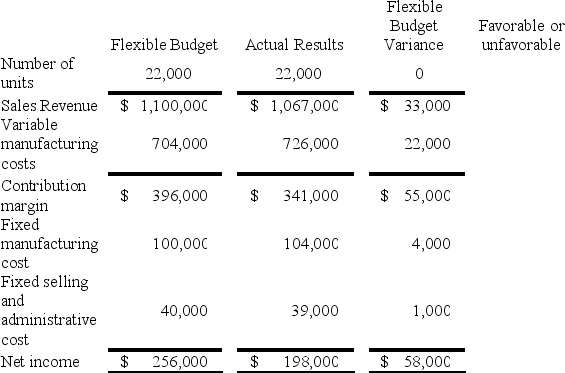

Douglas Company provided the following budgeted information for the current year.

Douglas predicted that sales would be 20,000 units,but the sales actually were 22,000 units.The actual sales price was $48.50 per unit,and the actual variable manufacturing cost was $33 per unit.Actual fixed manufacturing cost and fixed selling and administrative cost were $104,000 and $39,000,respectively.

Required:

(a)Using the form below,prepare a flexible budget,show actual results,calculate the flexible budget variances,and indicate whether the variances are favorable (F)or unfavorable (U).

(b)Assess the company's performance compared to the flexible budget.

(b)Assess the company's performance compared to the flexible budget.

Definitions:

Total Utility

The complete contentment derived from the consumption of a specific amount of a product or service.

Fair Bet

A gamble where the expected value of the potential outcomes is equal, implying that there is no net advantage or disadvantage to participating.

Zero Sum Game

A situation in game theory in which one participant's gains result exactly from losses incurred by other participants.

Expected Value

A calculated average of all possible values in a given probability distribution, weighted by the likelihood of each outcome.

Q1: A product-level activity center would likely include

Q11: Relevant costs are often referred to as:<br>A)

Q36: Tableware Unlimited Company plans to sell

Q53: Indicate whether each of the following statements

Q53: A cash flow that only occurs in

Q78: Ballantine Company manufactures two products.Currently,the company

Q84: Garrison Company has two investment opportunities.A

Q85: Najimi Enterprises recently began selling on the

Q102: Which activity is likely to be involved

Q134: Multiplying the difference between actual materials price