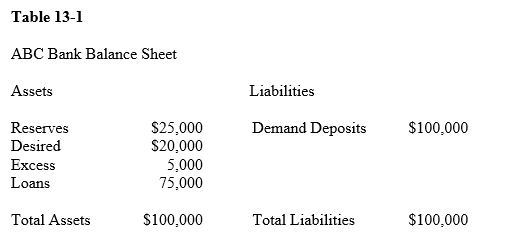

Table 13-1

-In Table 13-1,suppose that $20,000 in new deposits is received by the bank.If there were no other changes in the balance sheet,then the bank would be in a position to make new loans in the amount of

Definitions:

Compounded Monthly

Interest calculated on the initial principal and also on the accumulated interest of previous periods, with the process happening every month.

Compounded Semi-annually

Interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods, applied twice a year.

Equivalent Cash

A term typically used to describe a sum of money that has the same value as another form of financial instrument or asset.

Compounded Semi-annually

Involves the calculation and addition of interest to the principal sum twice per year.

Q20: An advantage of automatic stabilizers over discretionary

Q34: Why was the WTO,formerly GATT,created?

Q46: The effect time lag of fiscal policy

Q57: In Figure 9-1,line ABC is called<br>A)the 45-degree

Q85: Following a new deposit of $200,a commercial

Q97: The break-even point on the consumption function

Q99: If depository insurance exists,bank managers may make

Q99: When real national income exceeds total expenditures,<br>A)there

Q107: We know that discretionary fiscal policy<br>A)is never

Q118: According to both the equation of exchange