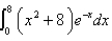

Evaluate the integral.

Definitions:

Agricultural Adjustment Act

A U.S. federal law of the New Deal era designed to boost agricultural prices by reducing surpluses.

Agricultural Prices

The amount of money required to purchase agricultural products, which can fluctuate based on factors like supply, demand, weather conditions, and market trends.

Supply

The total amount of a product or service available for purchase at any given price level in a given market.

Fiscal Policy

Government policies regarding taxation and spending that aim to influence economic conditions, such as growth rates, inflation, and unemployment.

Q1: Evaluate the integral by reversing the order

Q2: Under FHA procedures, all of the following

Q2: An electric charge is spread over a

Q2: The principle of appraising that considers the

Q4: Does it matter how much a developing

Q5: Approximate by a Taylor polynomial with degree

Q5: Find the area of the surface obtained

Q6: Determining for sure whether or not a

Q12: Which FHA Program Section has been phased

Q63: Police depend upon the public to<br>A)report crimes