The accounting records of Marcus Service Company include the following selected,unadjusted balances at June 30: Accounts Receivable,$2,700;Office Supplies,$1,800;Prepaid Rent,$3,600;Equipment,$15,000;Accumulated Depreciation - Equipment,$1,800;Salaries Payable,$0;Unearned Revenue,$2,400;Office Supplies Expense,$2,800;Rent Expense,$0;Salaries Expense,$15,000;Service Revenue,$40,500.

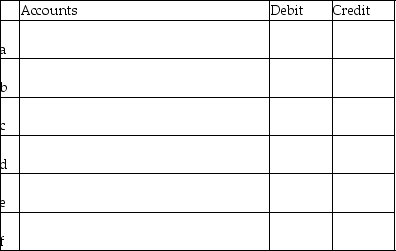

The following data developed for adjusting entries are as follows:

a.Service revenue accrued,$1,400

b.Unearned Revenue that has been earned,$800

c.Office Supplies on hand,$700

d.Salaries owed to employees,$1,800

e.One month of prepaid rent has expired,$1,200

f.Depreciation on equipment,$1,500

Journalize the adjusting entries.Omit explanations.

Definitions:

Common Law

A body of law derived from judicial decisions of courts and similar tribunals, as opposed to statutes or constitutions.

Valid Deed

A valid deed is a legally enforceable document that effectively transfers ownership of real property from one party to another, and must meet specific requirements, including the signature of the grantor and delivery.

Recording

The act of documenting or entering official information, such as deeds and mortgages, into public records.

Enabling Statute

A law that gives a government entity or agency the authority to take specific actions.

Q18: A merchandiser sold merchandise inventory on account.The

Q20: The Salaries Expense account is a temporary

Q31: Ace,Inc.had the following transactions during June:<br>Performed services

Q33: A reduction in the amount of cash

Q48: The entry to record depreciation includes a

Q55: In a corporation,the stockholders are personally liable

Q94: "All debits are increases and all credits

Q107: The process of transferring data from the

Q114: Harvard Financial Services purchased computers that are

Q165: If goods are sold on terms FOB