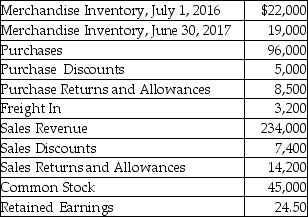

Brookside Equipment Company uses the periodic inventory system.Brookside reported the following selected amounts at June 30,2017:

Requirement A: Compute net sales revenue.

Definitions:

Tax Deductible

Tax deductible refers to certain expenses or investments that can be subtracted from gross income to reduce the amount of income subject to tax.

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to use and wear and tear.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Deferred Tax Asset

A financial statement item that represents an entity's right to reduce future tax payments due to temporary differences or certain carryover losses.

Q6: The adjusted trial balance of Shutterbug Photography

Q6: A company purchased inventory for $3,000 from

Q19: Which of the following inventory costing methods

Q51: Kittery Services purchased computers that are to

Q61: A merchandiser's statement of owner's equity looks

Q103: Kostner Financial Services performed accounting services for

Q121: The bank made an EFT payment of

Q122: Why is it necessary to journalize transactions

Q137: A petty cash fund was established with

Q145: The ending Merchandise Inventory for the current