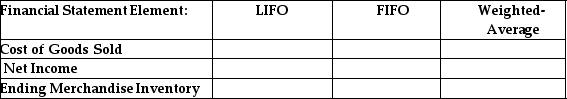

Complete the following table,which compares the effects of LIFO,FIFO and weighted-average inventory costing methods on the financial statements in periods of declining inventory costs.The answer should be lowest,highest,or middle.

Definitions:

Employment Tests

Assessments used by employers to evaluate candidates' skills, aptitudes, or suitability for specific roles during the hiring process.

Job Requirements

The specific qualifications, skills, and experience deemed necessary for a person to successfully perform a particular job.

Leading Questions

Questions framed in a way that suggests the desired answer, often used in interviews and surveys to influence the respondent's answer.

Job-related Information

Data or details pertaining to employment opportunities, responsibilities, requirements, and conditions.

Q28: Because of the risk of fraud,electronic invoices

Q32: A company has $100,000 in current assets;$600,000

Q35: Gross profit is the extra amount the

Q49: A company's Cash account shows an ending

Q77: Smart Art is a new business.During its

Q129: Which of the following inventory costing methods

Q136: When a check is issued,the party who

Q156: Regarding a classified balance sheet,which of the

Q166: The purchase discount amount is calculated on

Q168: Under the perpetual inventory system,the journal entry