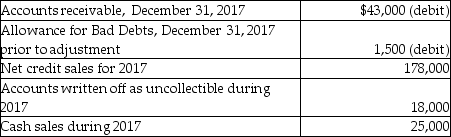

The following information is from the 2017 records of Armand Music Shop:

Bad debts expense is estimated by the percent-of-sales method.Management estimates that 6% of net credit sales will be uncollectible.Calculate the amount of bad debts expense for 2017.

Definitions:

Partnerships

Partnerships indicate a legal form of business operation between two or more individuals who share management and profits.

Corporations

Legal entities that are separate from their owners, offering limited liability to shareholders, and having the ability to own property, sue, or be sued.

Cost Principle

An accounting principle that states assets should be recorded at their cost at the time of purchase, not at their current value.

Accounting Records

Documents and records that a business maintains to keep track of its financial transactions, assets, and liabilities.

Q19: Federal income taxes are _.<br>A)deducted to arrive

Q31: The purchases journal is a special journal

Q42: Smart Calendars is a new business.During its

Q55: Since a computerized system uses software to

Q60: The percent-of-sales method,used to compute bad debt

Q106: A contingency was evaluated at year-end and

Q133: On June 30,2017,Adilide,Inc.discarded equipment costing $40,000.Accumulated Depreciation

Q133: In a limited liability partnership,each partner is

Q137: Using the LIFO method of inventory valuation

Q141: The accounts payable subsidiary ledger _.<br>A)does not