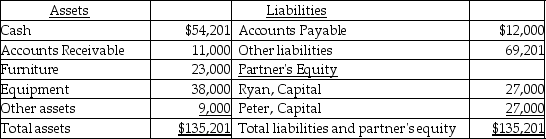

The balance sheet of Ryan and Peter firm as on December 31,2017,is given below.

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.The furniture and the equipment were sold at a cumulative loss of $4,000.The accounts receivable were received in cash and the other assets were written off as worthless.The accounts payable and other liabilities were paid off at book value.The firm's accountant distributed the remaining cash between Ryan and Peter equally.However,Peter initiated a lawsuit claiming that his share was greater than Ryan's.How much should Peter have received?

Definitions:

Necessary

An essential requirement or condition that must be met or possessed for a particular purpose or outcome.

Enumerated Powers

Specific powers granted to an entity, often a governmental body, explicitly listed in a constitution or similar governing document.

Proper Clause

Likely a mistake for "Necessary and Proper Clause," which grants Congress the power to pass all laws necessary and proper for executing its enumerated powers.

Federal Reserve System

The central banking system of the United States, responsible for the nation's monetary policy and regulation of the banking industry.

Q1: On January 1,2017,Shea Landscaping borrowed $100,000 on

Q10: The entry to record the payment of

Q16: When a business sells a plant asset

Q51: In a partnership,the income is taxed at

Q58: On January 1,2017,Agee Company issued $89,000 of

Q62: On March 1,2016,Hughes Services issued a 9%

Q76: On July 1,2017,Adams Company has bonds with

Q134: Treasury stock is recorded at cost,without reference

Q159: Admission of a new partner,by contributing directly

Q162: Barter,Inc.sold goods for $894,500 on account.The company