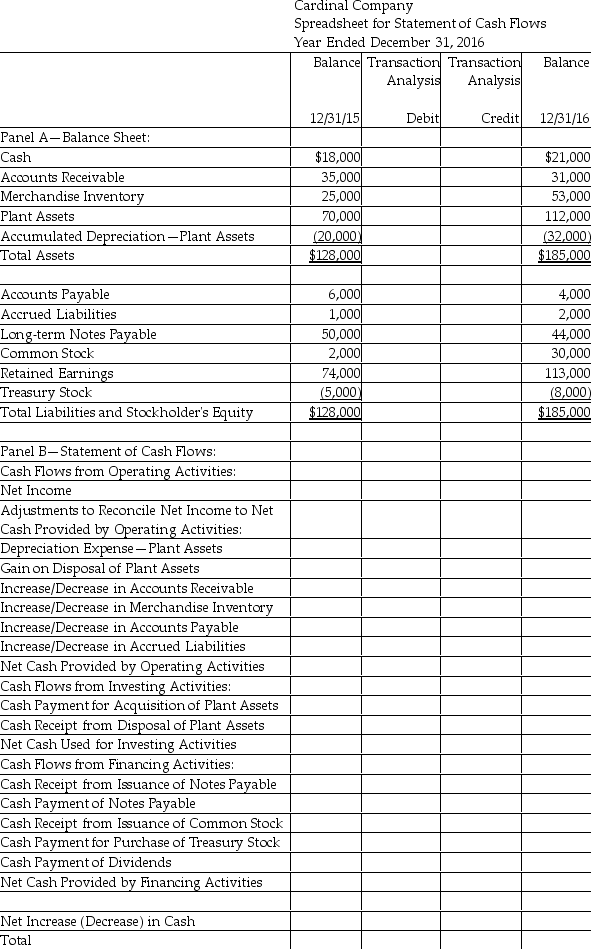

Cardinal Company uses the indirect method to prepare its statement of cash flows.Using the following information,complete the worksheet for the year ended December 31,2016.

- Net Income for the year ended December 31,2016 was $49,000

- Depreciation expense for 2016 was $12,000

- During 2016,plant assets with a book value of $10,000 (cost $10,000 and accumulated depreciation $0)were sold for $14,000

- Plant assets were acquired for $52,000 cash

- Issued common stock for $28,000

- Issued long-term notes payable for $34,000

- Repaid long-term notes payable for $40,000

- Purchased treasury stock for 3,000

- Paid dividends of $10,000

Definitions:

Income from Operations

The earnings generated from a business's core activities, excluding revenues and expenses from non-operational activities.

Perpetual Inventory System

An accounting method that continuously updates inventory records for each purchase and sale of inventory.

Cost of Merchandise Sold

The total cost incurred to purchase or manufacture the goods sold during a specific period.

FOB Shipping Point

A term used in shipping indicating that the buyer assumes responsibility for the goods and the cost of transportation once the goods leave the seller’s premises.

Q13: A high times-interest-earned ratio indicates difficulty in

Q18: Significant interest investments are reported as _

Q21: Kapow,Inc.provides the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5024/.jpg" alt="Kapow,Inc.provides the

Q32: On December 31,2017,Clark Sales has 10-year Bonds

Q39: For available-for-sale investments,state:<br>• Reporting method used<br>• How

Q91: Management's discussion and analysis of financial condition

Q99: How does a merchandise company calculate unit

Q131: Debt securities do not include U.S.government securities.

Q142: Freight costs paid to ship raw materials

Q165: Bryant,Inc.provides the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5024/.jpg" alt="Bryant,Inc.provides the