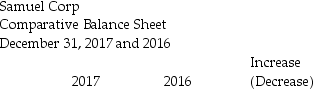

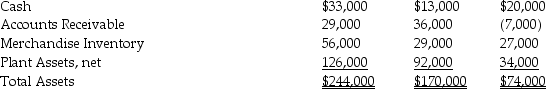

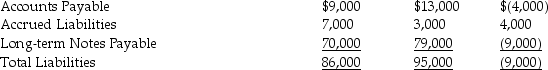

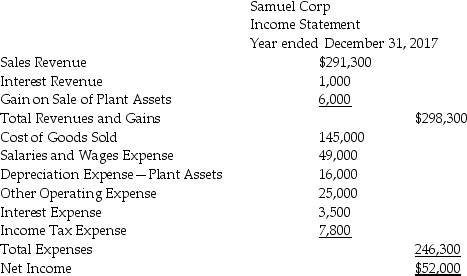

Samuel Corp.has provided the following information for the year ended December 31,2017.

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net book value of $10,000 was sold for $16,000.

Depreciation expense of $16,000 was recorded during the year.

During 2017,the company repaid $43,000 of long-term notes payable.

During 2017,the company borrowed $34,000 on a new long-term note payable.

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare the 2017 statement of cash flows,using the indirect method.

Definitions:

Free Will

The concept or belief that human beings possess the capacity to make choices that are not predetermined by past events, genetics, or environmental factors.

Positive Psychologist

A positive psychologist focuses on studying and enhancing the positive aspects of human life, such as well-being, happiness, and fulfillment.

Grateful

Feeling or showing appreciation for something done or received.

Brain's Activity

The complex functionalities and processes executed by the brain, including thinking, feeling, perceiving, and coordinating physical actions.

Q14: Which of the following securities typically pays

Q29: McDaniel,Inc.uses the direct method to prepare its

Q40: Which of the following statements accurately describes

Q55: The statement of cash flows helps users

Q58: In a manufacturing company,advertising and marketing costs

Q115: Small stock dividends increase the Paid-In Capital

Q119: Simons,Inc.sells plasticware.The following information summarizes Simons' operating

Q129: Which of the following requires a formal

Q154: Repair and maintenance costs of vehicles used

Q188: Direct costs and indirect costs can be