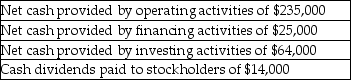

Jackson & Murphy Enterprises expects the following for 2017:

The business plans to spend $102,000 to purchase equipment.

What is the expected amount of free cash flow for 2017?

Definitions:

Times Interest Earned

A ratio that measures a company's ability to meet its debt obligations, calculated by dividing earnings before interest and taxes by the interest expense.

Debt-To-Equity Ratio

A financial ratio indicating the relative proportion of shareholder's equity and debt used to finance a company's assets.

Equity Multiplier

A financial leverage ratio that measures the portion of a company`s assets that are financed by its shareholders' equity.

Price-Earnings Ratio

A valuation ratio comparing a company’s current share price to its per-share earnings, helping investors evaluate if a stock is over or under-valued.

Q11: Working capital measures a business's ability to

Q50: Bright Eyes Paints Company uses the direct

Q85: When a job order costing system is

Q98: Long-term investments _.<br>A)include all debt securities that

Q112: The rate of return on total assets

Q118: The statement of cash flows explains why

Q144: Prepare a comparative common-size income statement for

Q149: For a manufacturing company,which of the following

Q158: Manufacturing overhead is allocated by debiting the

Q173: When bonds are retired at maturity _.<br>A)the