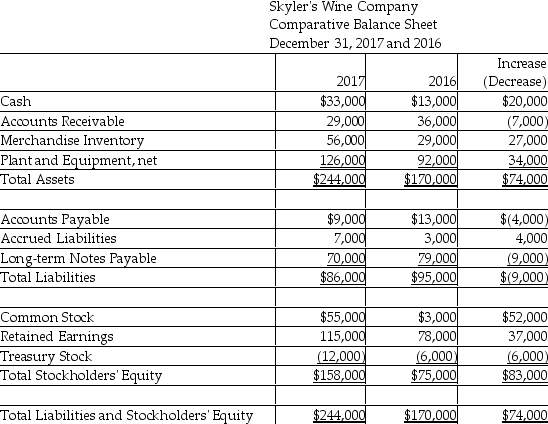

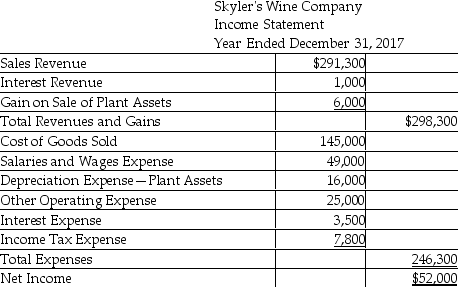

Skyler's Wine Company uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ending December 31,2017:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

During 2017,the company repaid $43,000 of long-term notes payable.

During 2017,the company borrowed $34,000 on a new note payable.

There were no stock retirements during the year.

There were no sales of Treasury Stock during the year.

Prepare a complete statement of cash flows using the direct method.

Accrued Liabilities relate to other operating expenses.

Definitions:

Balance Sheet

The balance sheet is a financial statement that reports a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a snapshot of its financial condition.

Telephone Expense

This represents the cost associated with telephone usage and services for a business, classified as an office expense.

Fees Earned

Fees earned refer to the income a company receives from providing services to its clients, typically recorded in the income statement.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, culminating in net profit or loss.

Q26: One of the purposes of the statement

Q28: On January 1,2017,Citywide Sales issued $32,000 in

Q51: Provide a definition of each of the

Q82: A corporation's income statement includes some unique

Q126: Which of the following is included in

Q137: When a company receives interest revenue on

Q140: Robbinsdale,Inc.is a merchandiser of stone ornaments.The company

Q156: Gains and losses on the normal sale

Q157: Interest expense paid on a note payable

Q163: Which of the following statements is true