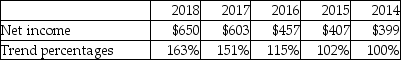

The trend analysis report of Marshall,Inc.is given below (in millions) :

Which of the following is a correct conclusion from the above analysis?

Definitions:

Capital Asset Pricing Model

A theory detailing how systematic risk correlates with the expected return for investments, mainly in the stock market.

Stock Correlation

A statistical measure that describes how the movements of two stocks are related to each other.

Risky Assets

Assets that carry a significant degree of risk of loss, often associated with higher potential returns as compensation for the risk taken.

Market Risk Premium

The extra return over the risk-free rate that investors require to compensate them for the risk of investing in the stock market.

Q13: The fact that invested cash earns interest

Q23: The following is a summary of information

Q43: The financing activities section of a statement

Q48: Certified Auto Parts Company uses the indirect

Q64: Geary,Inc.provides the following historical data:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5024/.jpg"

Q96: A company that is controlled by another

Q112: Hillsborough Glassware Company issues $1,061,000 of its

Q137: Which of the following statements is true

Q139: Using the effective-interest amortization method,the amount of

Q144: Jelly Bean Company uses the indirect method