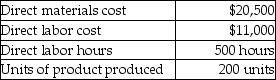

Irene Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,the company estimated total manufacturing overhead costs at $1,000,000 and total direct labor costs at $820,000.In June,Job 711 was completed.The details of Job 711 are shown below.

How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent. )

Definitions:

Marginal Revenue

The supplementary earnings obtained through the sale of an additional product or service unit.

Marginal Cost

The increase in total cost that arises from producing one additional unit of a product or service.

Average Total Cost

The cost per unit of output, determined by dividing the overall production cost by the number of units produced.

Long Run

A period in which all factors of production and costs are variable, allowing for full adjustment to market changes.

Q16: Babson Sugar,Inc.has six processing departments for refining

Q31: Which of the following is not a

Q85: In process costing,factory rent and utilities are

Q93: If a business operates in an industry

Q94: The vertical analysis statement of Bateman,Inc.is as

Q97: The audit report in the annual report

Q103: Accounting firms,building contractors,and healthcare providers use process

Q127: One of the primary activities of Rex,Inc.is

Q134: Badlands,Inc.reports the following information for the year

Q157: Interest expense paid on a note payable