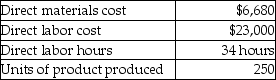

Venus Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 20% of the direct labor cost.In the month of June,Venus completed Job 13C and its details are as follows:

What is the total cost incurred for Job 13C?

Definitions:

Q5: The production cost report for Department 2

Q16: Extraordinary items are both unusual and infrequent

Q52: Effects Manufacturing produces a pesticide chemical and

Q63: Which of the following is the primary

Q87: Franco Company has variable costs of $0.65

Q102: Manufacturing overhead costs are allocated to the

Q111: Muses Manufacturing produces plastic toys and uses

Q118: In a manufacturing company,accounting,legal,and administrative costs are

Q183: Torres Manufacturers produces flooring material.The monthly fixed

Q186: Fixed costs per unit decrease as production