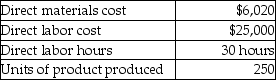

Jordan Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 30% times the direct labor cost.In the month of June,Jordan completed Job 13C,and its details are as follows:

What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent. )

Definitions:

Unemployment Compensation

Government-provided financial assistance to individuals who are unemployed and meet certain eligibility requirements.

Automatic Stabilizer

Economic policies and programs, such as unemployment insurance and progressive taxes, that automatically help stabilize an economy by reducing the severity of economic fluctuations without additional government intervention.

Disposable Income

The residual financial power of households for savings and consumption post the subtraction of income taxes.

Inflationary Pressure

Situations where upward trends in prices are predicted due to factors such as increased production costs or rising demand.

Q34: The following is summary of information presented

Q46: The rate of return on total assets

Q67: Connors,Inc.provides the following information for 2017:<br> <img

Q69: Which of the following describes working capital?<br>A)Current

Q103: Accounting firms,building contractors,and healthcare providers use process

Q115: Tuesday Electric Company uses the direct method

Q131: Which of the following best describes the

Q134: Badlands,Inc.reports the following information for the year

Q155: What does free cash flow represent? How

Q156: A cellular phone manufacturer is more likely