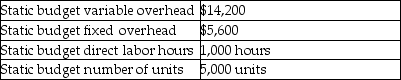

The following information relates to Regency Manufacturing's overhead costs for the month:

Regency allocates manufacturing overhead to production based on standard direct labor hours.

Regency reported the following actual results for last month: actual variable overhead,$14,500;actual fixed overhead,$5,400;actual production of 4,700 units at 0.22 direct labor hours per unit.The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead cost variance.(Round the answer to the nearest dollar. )

Definitions:

Disposable Income

The total funds available for spending and saving by households after subtracting income taxes.

Savings

Money set aside from personal income for future use, often placed in secure accounts or investments for growth or as a safeguard.

Disposable Income

Funds households are left with for saving or expenditure after income taxes are taken out.

APC (Average Propensity to Consume)

The fraction of income that is spent on consumption as opposed to savings.

Q25: The breakeven point is the point where

Q35: An objective of the budgeting process is

Q38: Johnson Construction Materials Company has a sales

Q81: Net cash inflows from a capital investment

Q89: An intentional understatement of expected revenues or

Q96: A company with different segments using different

Q116: Grand Products is a price-setter that uses

Q150: Costs that do not differ between alternatives

Q153: The traditional income statement format is prepared

Q186: Centralized operations are better for small companies