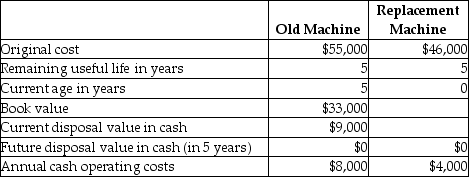

Smith Industries is considering replacing a machine that is presently used in its production process.

Which of the following is irrelevant to the replacement decision?

Which of the information provided in the table is irrelevant to the replacement decision?

Definitions:

Impairment Loss

A reduction in the book value of an asset when its fair market value falls below its carrying amount on the balance sheet, indicating a permanent decline in value.

Accumulated Depreciation

Represents the total depreciation expenses charged against a fixed asset since it was put into use, reflecting its decrease in value over time.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into use, reducing its book value.

Gain of $2,000

Represents an increase in wealth or resources, typically accounted for in financial statements when an asset is sold for more than its cost.

Q17: A company is setting its direct materials

Q45: Robinson Manufacturing uses a standard cost system.The

Q53: Which of the following best describes a

Q58: A favorable flexible budget variance in sales

Q94: McGrath's produces and sells two types of

Q111: Archid,Inc. ,a manufacturer of spare parts,has two

Q116: Which would be an appropriate cost driver

Q121: Management decisions are based primarily on quantitative

Q154: High Seas Sail Makers manufactures sails for

Q193: The management of Alpha Lawnmowers has calculated