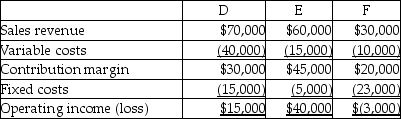

Cambridge Roller Skates has three product lines-D,E,and F.The following information is available:

The company is deciding whether to drop product line F because it has an operating loss.Assume that $21,000 of total fixed costs could be eliminated by dropping F.What effect would this decision have on operating income?

Definitions:

FICA-OASDI

Represents the Federal Insurance Contributions Act's Old-Age, Survivors, and Disability Insurance, a U.S. payroll tax that funds Social Security.

FICA-Medicare

The portion of the Federal Insurance Contributions Act tax that is allocated to Medicare, funding hospital insurance benefits for individuals who are elderly or disabled.

Payroll Register

A document that records detailed information about the compensation paid to employees, including wages, deductions, and net pay.

W-2 Forms

Official tax documents that employers send to employees and the IRS, reporting the employee's annual wages and the amount of taxes withheld from their paycheck.

Q30: A firm has 500 shares of stock

Q39: The maximum value of a call option

Q40: Davis Naturals manufactures bulk quantities of cleaning

Q48: A bond/warrant package is priced to sell

Q99: A lag indicator is a performance measure

Q106: List two strengths and one weakness of

Q128: List the two factors that the financial

Q138: Sales revenue growth,gross margin growth,and return on

Q141: The accounting rate of return is calculated

Q150: A static budget is prepared for only