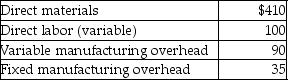

CM Company manufactures a component used in the production of one of its main products.The following cost information is available:

A supplier has offered to sell the component to CM for $630 per unit.If CM buys the component from the supplier,the released facilities can be used to manufacture a product that would generate a contribution margin of $10,000 annually.Assuming that CM needs 4,000 components annually and that the fixed manufacturing overhead is unavoidable,what would be the impact on operating income if CM outsources?

Definitions:

Economic Profit

The differential tally between gross receipts and total obligations, including costs both acknowledged and undeclared.

Average Variable Cost

The total variable cost per unit of output, calculated by dividing total variable costs by the quantity of output.

MR = MC

Marginal Revenue equals Marginal Cost; a condition used to determine the profit-maximizing level of output for a firm.

Profit-maximizing Quantity

The level of output at which a business realizes the greatest profit, where marginal cost equals marginal revenue.

Q7: Calculate the duration of a 7-year $1,000

Q19: Meson Productions is a price-taker.Meson produces large

Q21: Concerning convertible bonds,which of the following statements

Q31: Explain the difference between a controllable and

Q36: Star Stationery Company is a price-taker and

Q41: A profit center performance report includes both

Q76: Suppose that the spot rate on the

Q84: International bonds issued in a single country

Q136: The standard cost income statement doesn't alter

Q143: Global Engineering's actual operating income for the