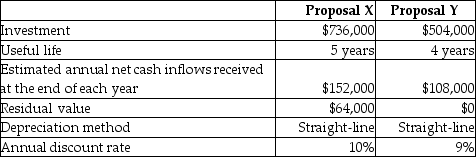

Gordon Manufacturing is considering following two investment proposals:

Compute the present value of the future cash inflows from Proposal X.

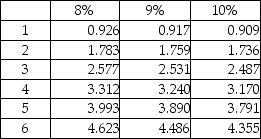

Present value of an ordinary annuity of $1:

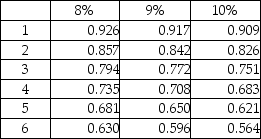

Present value of $1:

Definitions:

Municipal Bonds

Bonds issued by local, state, or county governments to finance public projects, typically offering tax-exempt interest payments.

Deferred Income Taxes

Tax liabilities that arise due to timing differences between the recognition of income and expenses in the financial statements and their recognition in the tax returns, deferred to future periods.

Life Insurance Proceeds

The amount of money paid out to the beneficiary of a life insurance policy upon the death of the insured or at the policy's maturity.

Deferred Tax Liability

An accounting term representing a tax obligation that a company owes but is allowed to pay at a future date.

Q16: The expected inflation rate in Switzerland is

Q27: Derivatives can be used to either hedge

Q29: If the ex-rights price were set at

Q40: Davis Naturals manufactures bulk quantities of cleaning

Q45: To compute the value of a put

Q80: Interest rate parity:<br>A)eliminates covered interest arbitrage opportunities.<br>B)exists

Q84: Jeff opted to exercise his August option

Q88: Revenue center responsibility reports show all costs

Q121: If upper management uses a short time

Q124: Atlace Manufacturing uses a standard cost system.Standards