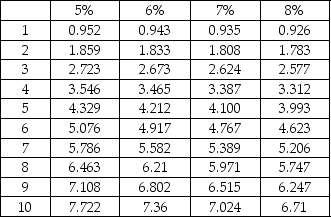

Lobel Machines Company is evaluating an investment of $1,550,000 which will yield net cash inflows of $220,672 per year for 10 years with no residual value.What is the internal rate of return?

Present value of ordinary annuity of $1:

Definitions:

Fixed Overhead Budget Variance

The difference between actual fixed overhead costs and the budgeted or expected fixed overhead costs.

Volume Variance

A measure of the difference between the budgeted and actual volume of production, impacting costs.

Overhead Variances

The difference between actual overhead costs and the budgeted or standard overhead costs.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or job orders, calculated before the costs are actually incurred.

Q6: Financial deficits are created when:<br>A)profits and retained

Q27: Spot trades must be settled:<br>A)on the day

Q30: Lighthouse Sail Makers manufactures sails for sailboats.The

Q30: An equity issue sold directly to the

Q36: Under the _ method,the underwriter buys the

Q43: The condition stating that the current forward

Q50: If the warrants are all exercised immediately,what

Q55: The reputational capital of investment bankers is

Q126: A major criticism of the payback method

Q180: Which of the following is the correct