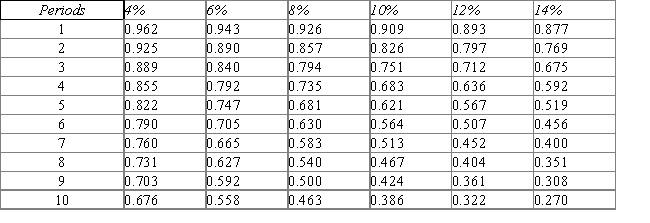

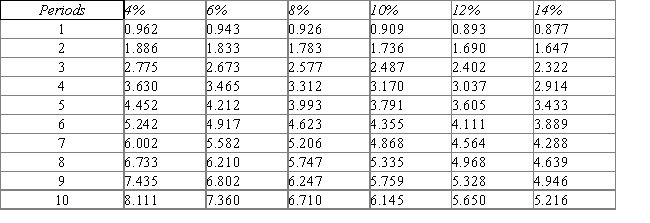

Present value of $1  Present value of an Annuity of $1

Present value of an Annuity of $1

Morgan Clinical Practice is considering an investment in new imaging equipment that will cost $400,000.The equipment is expected to yield cash inflows of $80,000 per year for a six year period.Morgan set a required rate of return at 10%.

- What is the net present value of the investment? (Note: there may be a rounding error depending on the table you use to compute your answer.Choose the answer closest to the one you calculate.)

Definitions:

Q44: In general, it is best if postaudits

Q45: Excellent customer service is an example of

Q47: Which of the following is true regarding

Q65: Last year, Violet Company reported cost of

Q67: Turnover is the ratio of sales to

Q81: Which of the following formulas measures turnover?<br>A)

Q87: Which of the following investing activities results

Q95: A postaudit is an analysis of a

Q107: Tangarine Company is considering a project with

Q199: Labor Rate Variance<br>A)Actual Quantity × Actual Price<br>B)(Actual