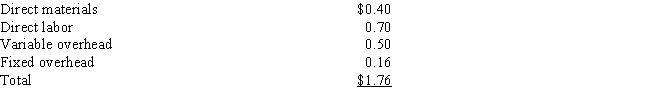

Elite Inc.has many divisions that are evaluated on the basis of return on investment (ROI) .One division, Beta, makes boxes.A second division, Lambda, makes chocolates and needs 90,000 boxes per year.Beta incurs the following costs for one box:

Beta has the capacity to make 720,000 boxes per year.Lambda currently buys its boxes from an outside supplier for $2.00 each (the same price that Beta receives) .

- Assume that Elite Inc.allows division managers to negotiate transfer price.Beta is producing 720,000 boxes.If Beta and Lambda agree to transfer boxes, what is the floor of the bargaining range and which division sets it?

Definitions:

Carotid Chemoreceptors

Sensory receptors located in the carotid arteries that detect changes in blood oxygen levels, helping regulate breathing.

Baroreceptors

Sensory nerve endings located in the walls of blood vessels that detect changes in blood pressure and help regulate it.

Lymphatics

Part of the lymphatic system, involving the network of vessels, nodes, and organs responsible for transporting lymph and managing bodily fluids.

Edema

A condition characterized by an excess of watery fluid accumulating in the cavities or tissues of the body.

Q4: The detailed formulation of action to achieve

Q7: The spot rate for the pound is

Q7: Which of the following are true statements?<br>I.Venture

Q14: What is the primary purpose of a

Q40: Which one of the following statements is

Q47: Which of the following is true regarding

Q57: The price charged for the transferred good

Q58: Which of the following is true of

Q71: The practice of delegating decision-making authority to

Q96: Which of the following is the difference