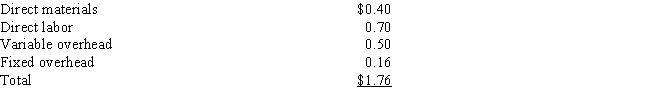

Elite Inc.has many divisions that are evaluated on the basis of return on investment (ROI) .One division, Beta, makes boxes.A second division, Lambda, makes chocolates and needs 90,000 boxes per year.Beta incurs the following costs for one box:

Beta has the capacity to make 720,000 boxes per year.Lambda currently buys its boxes from an outside supplier for $2.00 each (the same price that Beta receives) .

-Assume that Elite Inc.mandates that any transfers take place at full manufacturing cost. What would be the transfer price if Beta transferred boxes to Lambda?

Definitions:

Cost of Goods Sold

Cost of Goods Sold (COGS) refers to the direct costs attributable to the production of the goods sold in a company.

Periodic Inventory System

An inventory accounting system where updates are made at intervals, such as monthly or annually, rather than continuously.

FIFO

"First In, First Out," an inventory valuation method where goods first acquired are the first sold or used, affecting cost of goods sold and inventory value.

LIFO

An inventory valuation method that assumes the last items of inventory purchased are the first ones sold ("Last In, First Out").

Q20: Mover Company has developed the following standards

Q22: The _ is the difference between actual

Q38: Which one of the following is the

Q59: Which of the following is true of

Q76: comparison of actual benefits and costs of

Q80: Decentralization is usually achieved by creating units

Q84: Worksheets offer increased _ in form and

Q105: <br>What is the journal entry to record

Q107: Tangarine Company is considering a project with

Q119: Which of the following represents an advantage