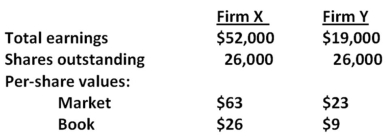

Consider the following premerger information about Firm X and Firm Y:

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

Definitions:

Underapplied Manufacturing Overhead

A situation where the actual manufacturing overhead costs exceed the applied (or allocated) manufacturing overhead costs.

Allocation

Allocation refers to the process of distributing resources, costs, or revenues among various accounts or departments within an organization based on predetermined criteria.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including materials, labor, and manufacturing overhead.

Cost of Goods Available

The total cost of inventory that is available for sale at the beginning of a period, including purchases made during that period.

Q25: A capital lease is recorded as an

Q52: What is the value of a 3-month

Q62: A stock is selling for $60 per

Q66: Amy is a current shareholder of DJ

Q69: Party A has agreed to exchange $1

Q71: Alpha is planning on merging with Beta.Alpha

Q83: Which one of the following states that

Q112: In the early 1970s, in an attempt

Q160: Under the gold standard, all except one

Q179: Which of the following is not considered