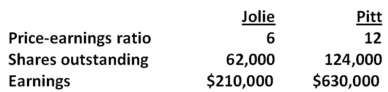

The shareholders of Jolie Company have voted in favor of a buyout offer from Pitt Corporation.Information about each firm is given here:

Jolie's shareholders will receive one share of Pitt stock for every three shares they hold in Jolie.Assume the NPV of the acquisition is zero.What will the post-merger PE ratio be for Pitt?

Definitions:

Self-Managed Team

A group of employees who are responsible for all aspects of their work, from planning and execution to monitoring their own performance.

Centralized Leadership

Centralized leadership is a management structure where decision-making authority is concentrated at the top levels of an organization.

Normative Decision Model

The Normative Decision Model is a leadership theory that suggests the optimal decision-making process is determined by assessing different situations and choosing the most effective decision-making style.

Autocratic Decision

A decision-making style where the leader unilaterally decides without input or consultation from others.

Q3: When warrants are exercised,the:<br>A) earnings per share

Q12: All developed countries achieve their status as

Q19: If the exchange rate changes from 75

Q32: In the spot market,$1 is currently equal

Q33: Fireplaces and More is considering the purchase

Q67: Which of the following have been suggested

Q69: Party A has agreed to exchange $1

Q95: Which one of the following factors tends

Q140: Utopia would be a debtor nation<br>A)if consumers

Q182: Since 1983, the US has typically run