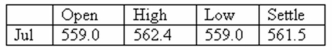

You expect to deliver 42,000 bushels of wheat to the market in July.Today,you hedge your position by selling futures contracts on half of your expected delivery at the final price of the day.Assume that the market price turns out to be 582.0 when you actually deliver the wheat.How much more or less would you have earned if you had not bought the futures contracts?

Wheat - 5,000 bu.: U.S.cents per bu.

Definitions:

Q7: Check kiting is:<br>A) used by most firms

Q7: To compute the value of a put

Q19: Bill feels that he possesses a good

Q29: Lessons about the nature of economic processes

Q31: A bank offers your firm a revolving

Q37: Which one of the following statements is

Q54: You sold ten put contracts on Cross

Q54: The forward rate market is dependent upon:<br>A)

Q58: On an average day,Town Center Hardware receives

Q83: A supplier grants your firm credit terms