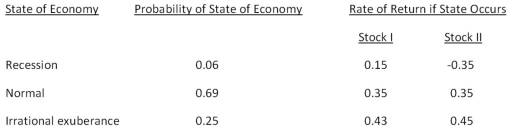

Consider the following information on Stocks I and II:

The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

Definitions:

Watching Condition

A scenario or setup in experiments where subjects observe events or behaviors without intervening, often used to gather naturalistic data.

Predicting Condition

Refers to specifying the criteria or conditions under which certain outcomes are expected to occur.

Dunnett Test

A post hoc test used after ANOVA to compare multiple groups against a single control group, assessing if there are significant differences between the control and each of the other groups.

Scheffé Test

A statistical procedure for comparing more than two means while controlling the overall Type I error rate.

Q7: Calculate the standard deviation of the following

Q28: Billingsley United declared a $0.20 a share

Q32: Which one of the following statements is

Q38: All else constant,which one of the following

Q44: Carson Electronics uses 70 percent common stock

Q67: Val's Marina Supply has 3,500 shares of

Q70: What is the amount of the risk

Q78: Uptown Promotions has three divisions.As part of

Q79: Jenningston Mills has a market value equal

Q82: Suppose a stock had an initial price