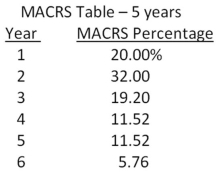

-Chapman Machine Shop is considering a 4-year project to improve its production efficiency.Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings.The press falls in the MACRS 5-year class,and it will have a salvage value at the end of the project of $84,000.The press also requires an initial investment in spare parts inventory of $24,000,along with an additional $3,600 in inventory for each succeeding year of the project.The inventory will return to its original level when the project ends.The shop's tax rate is 35 percent and its discount rate is 11 percent.Should the firm buy and install the machine press? Why or why not?

Definitions:

Euro

The legal tender of the eurozone, adopted by 19 countries among the 27 that comprise the European Union.

Exports

Goods or services sent from one country to another for sale.

Imports

Goods or services brought into one country from another for sale or use.

Skiing Equipment

Gear and tools designed for use in skiing, including skis, boots, and poles.

Q3: All of the following are related to

Q5: Chemical Mines has 5,000 shareholders and is

Q13: Miller Mfg.is analyzing a proposed project.The company

Q32: Which one of the following measures the

Q42: Suppose the following bond quote for the

Q65: Which one of the following characteristics best

Q66: Your company is reviewing a project with

Q80: Give an example of a situation where

Q99: The common stock of Jensen Shipping has

Q100: Panelli's is analyzing a project with an