-A project produces annual net income of $46,200,$51,800,and $62,900 over its 3-year life,respectively.The initial cost of the project is $675,000.This cost is depreciated straight-line to a zero book value over three years.What is the average accounting rate of return if the required discount rate is 14.5 percent?

Definitions:

Indirect Method

A cash flow statement preparation approach that adjusts net income for non-cash transactions and changes in working capital to calculate operating cash flow.

Comparative Balance Sheet

A financial statement that presents a company's assets, liabilities, and equity at two or more points in time, allowing for comparison and trend analysis.

Operating Activities

Operating activities include the primary revenue-generating activities of a business, as well as other activities that are not investing or financing activities, reflecting the company's core operations cash flow.

Comparative Balance Sheet

A financial statement that provides a snapshot of a company's assets, liabilities, and equity at two or more points in time for comparison.

Q12: Miller Brothers Hardware paid an annual dividend

Q13: The current dividend yield on Clayton's Metals

Q25: What is the annual percentage rate on

Q33: A project has an initial cost of

Q33: Trish receives $450 on the first of

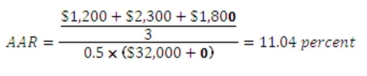

Q37: A firm evaluates all of its projects

Q55: Sailcloth & More currently produces boat sails

Q84: Dog Up! Franks is looking at a

Q93: A company has two open seats,Seat A

Q116: The items included in an indenture that