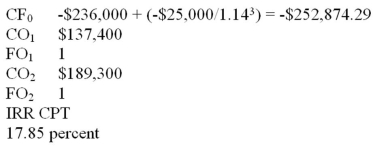

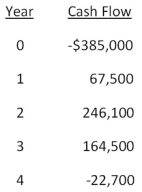

-Sheakley Industries is considering expanding its current line of business and has developed the following expected cash flows for the project.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 13.4 percent? Why or why not?

Definitions:

Shareholder's Wealth

The overall value that shareholders earn from their investment in a company, including dividends received and capital gains from share price appreciation.

Stock Split

A corporate action that increases the number of shares outstanding by issuing more shares to current shareholders, affecting share price.

Market Value

The existing cost at which a commodity or service is available for buying or selling in the market.

Shares Outstanding

The total number of shares that are currently owned by all shareholders, including share blocks held by institutional investors and restricted shares owned by the company’s officers and insiders.

Q12: The specified date on which the principal

Q28: Yesteryear Productions pays no dividend at the

Q32: The profitability index (PI)of a project is

Q43: Sara invested $500 six years ago at

Q43: Suppose you bought a 10 percent coupon

Q63: The stream of customer orders coming in

Q69: Southern Chicken is considering two projects.Project A

Q76: Which of the following are considered weaknesses

Q102: Galloway,Inc.has an odd dividend policy.The company has

Q114: You are borrowing $17,800 to buy a