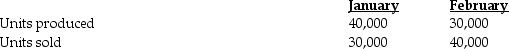

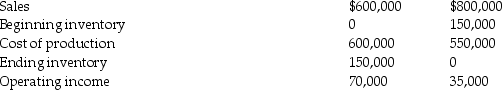

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up.Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5,and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences.How would variable costing income statements help the manager understand the division's operating income?

Definitions:

Great Recession

A significant decline in economic activity across the globe that occurred between 2007 and 2009, widely considered the largest downturn since the Great Depression.

Expected Profit Rate

The anticipated return on investment, calculated based on projected incomes and the inherent risks associated with an investment.

Interest Rate

A fee, denoted as a percentage of the principal sum, that a lender demands from a borrower to use assets.

Investment Project

A planned endeavour to invest capital in assets with the expectation of generating returns over time.

Q9: The effect of spreading fixed manufacturing costs

Q20: Theoretical capacity is unattainable in the real

Q33: The following table shows per-day production data

Q59: Comfort Company manufactures pillows.The 2015 operating budget

Q65: The U.S. dollar will appreciate if:<br>A)the U.S.

Q81: Nicholas Company manufacturers TVs.Some of the company's

Q86: A company purchases $650,000 of materials on

Q95: Standard labor rate is $7.50 per hour.Standard

Q103: Hockey Accessories Corporation manufactured 21,400 duffle

Q192: Beginning inventory + cost of goods manufactured