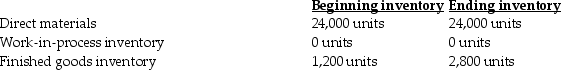

First Class,Inc. ,expects to sell 29,000 pool cues for $13 each.Direct materials costs are $3,direct manufacturing labor is $5,and manufacturing overhead is $0.83 per pool cue.The following inventory levels apply to 2019:

What are the 2019 budgeted costs for direct materials,direct manufacturing labor,and manufacturing overhead,respectively?

Definitions:

Social Security

A government program that provides financial assistance to people with little or no income, including retirement, disability, and survivor benefits.

Regressive

A tax system where the tax rate decreases as the taxable amount increases.

Purchasing Power

The value of a currency expressed in terms of the amount of goods or services that one unit of money can buy.

Real Rate of Return

The annual percentage return realized on an investment, adjusted for changes in the price level due to inflation or other external effects.

Q12: Increased used of automation,computer integrated manufacturing,and utilization

Q95: The _ is a component of financial

Q109: Allocating indirect costs to departments based on

Q109: Management accountants use the cost hierarchy to

Q118: Steve Corporation is using the kaizen approach

Q142: Which of the following is the correct

Q143: An effective plan for variable overhead costs

Q148: Which of the following is true of

Q165: Managers consider the accuracy gained by converting

Q165: A favorable production-volume variance arises when manufacturing