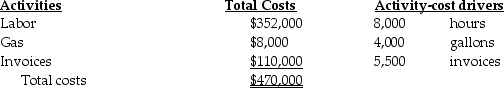

Columbus Company provides the following ABC costing information:

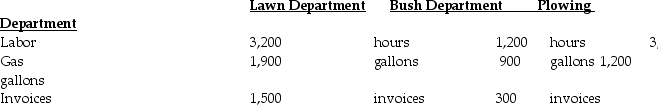

The above activities used by their three departments are:

How much of the gas cost will be assigned to the Lawn Department?

Definitions:

Causation

The relationship between cause and effect where one event (the cause) makes another event happen (the effect).

Usage Tax

Usage tax is a levy on the use of goods or services, typically calculated as a percentage of the purchasing price or a flat rate, aimed at specific products or activities.

Difference-In-Differences

is an econometric technique used to estimate the effect of a specific intervention or treatment by comparing the changes in outcomes over time between a treatment group and a control group.

Usage Tax

A tax imposed on the use of goods or services, typically applied to regulate or discourage certain behaviors.

Q9: Which of the following is the correct

Q14: Which of the following could be a

Q31: Gregory Enterprises has identified three cost pools

Q50: For externally reported inventory costs,the Work-in-Process Control

Q78: Which of the following is a financial

Q85: Genent Industries,Inc.(GII),developed standard costs for direct material

Q95: It is important that the product costs

Q111: Top management compensation cost is an example

Q142: ABC and traditional systems are quite similar

Q170: Process costing is _.<br>A)used to enhance employees'