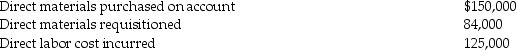

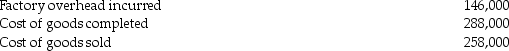

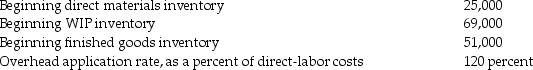

River Falls Manufacturing uses a normal cost system and had the following data available for 2018:

The journal entry to record the materials placed into production would include a ________.

Definitions:

Indirect Method

A technique used in cash flow statement preparation that adjusts net income for changes in non-cash accounts to calculate operating cash flow.

Net Cash Flows

The total amount of cash being transferred into and out of a business, after all revenues and expenses have been accounted for.

Accumulated Depreciation

The total amount of depreciation expense that has been charged against a fixed asset since it was put into use.

Investing Section

A part of the cash flow statement that shows the cash flow from all investing activities, which typically include purchases or sales of long-term assets like property, plant, and equipment.

Q8: Which of the following is a sign

Q21: Do activity-based costing systems always provide more

Q29: An example of a performance measure with

Q48: For each item below indicate the source

Q56: Dartmouth Corporation manufactures two models of office

Q62: A local CPA employs ten full-time professionals.The

Q94: The Japanese use kaizen to mean financing

Q100: Extreme Manufacturing Company provides the following ABC

Q114: Home Decor Inc. ,manufactures home cleaning products.The

Q121: Effort refers to physical exertion,such as a