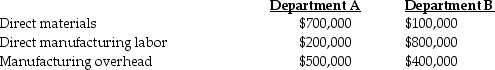

Apple Valley Corporation uses a job cost system and has two production departments,A and B.Budgeted manufacturing costs for the year are:

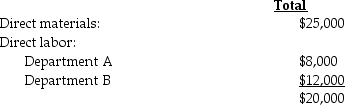

The actual material and labor costs charged to Job #432 were as follows:

Apple Valley applies manufacturing overhead costs to jobs on the basis of direct manufacturing labor cost using departmental rates determined at the beginning of the year.

For Department B,the manufacturing overhead allocation rate is ________.

Definitions:

Net Assets

The total assets of a company after deducting its total liabilities, representing the owners' equity in the company.

Common Shares

Equities representing ownership interests in a company, entitling holders to a share in the company's profits and voting rights in certain decisions.

Straight-Line Depreciation

An accounting method that allocates the cost of an asset evenly over its useful life.

Voting Stock

Shares in a company that give the shareholder the right to vote on company matters, such as electing the board of directors.

Q10: Costs such as supervision,plant and equipment (production)depreciation,maintenance,supplies,and

Q29: Which of the following is a reason

Q35: The budgeted indirect cost rate is actual

Q68: It is best to compare this year's

Q78: Globus Autos sells a single product.8,000 units

Q105: "Cooking the books" means reporting of understated

Q119: A materials-requisition record is an example of

Q140: _ is the process of varying key

Q171: Stark Corporation has two departments,Car Rental and

Q198: _ is used to record and accumulate