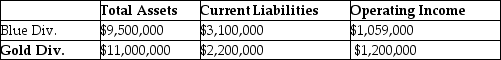

Springfield Corporation,whose tax rate is 30%,has two sources of funds: long-term debt with a market value of $8,400,000 and an interest rate of 8%,and equity capital with a market value of $14,000,000 and a cost of equity of 13%.Springfield has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places. )

Definitions:

Nirvana

In Buddhism, a transcendent state free from suffering and the cycle of rebirth and death, representing the ultimate spiritual goal.

Karma Yoga

A spiritual path in Hinduism emphasizing selfless action performed for the benefit of others as a way to spiritual liberation.

Detachment

Lack of willfulness or emotional concern. Detachment through ascetic denial (or, failing that, aesthetic contemplation) was proposed by the great pessimist Arthur Schopenhauer as a method of responding to the fact that life is filled with frustration due to our incessant irrational desires. Schopenhauer’s answer is similar to that of the ancient philosophy called Stoicism, which also teaches that most of our passions are irrational and are best ignored through the detachment and commitment to reason.

Golden Rule

A moral principle that suggests treating others as one would like to be treated themselves.

Q7: The real approach to incorporating inflation into

Q11: Retail Outlet is looking for a new

Q13: Which of the following is true about

Q55: Financial Planning Partners Inc. ,employs 12 full-time

Q68: Frazer Corp sells several products.Information of

Q100: Which option provides the least amount of

Q105: Assume the sales mix consists of three

Q110: A company should use cost-based transfer prices

Q120: Moto Corp allows its divisions to operate

Q135: The three common discounted cash flow methods