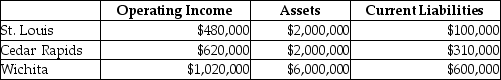

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%,and equity capital that has a market value of $4,200,000 (book value of $2,400,000) .Waldorf Company has profit centers in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 13%,while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places. )

Definitions:

Amortization Schedule

A table detailing each periodic payment on a loan over time, breaking down the amounts going towards principal and interest.

Interest Rate

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage.

Monthly Payments

Regular payments made every month, often in the context of loans or leasing agreements.

Callable Bond

A type of bond that gives the issuer the right to repay the bond before the maturity date.

Q11: Decentralization in multinational companies may lead to

Q13: River Falls Manufacturing uses a normal cost

Q19: Auto Tires has been in the tire

Q68: When companies do not want to use

Q74: Coptermagic Company supplies helicopters to corporate clients.Coptermagic

Q78: An additional criticism of team-based compensation is

Q79: Jordan Company has two departments,Assembly and Machining.Overhead

Q122: For each of the following statements regarding

Q124: Many manufacturing,marketing,and design problems require employees with

Q170: Process costing is _.<br>A)used to enhance employees'