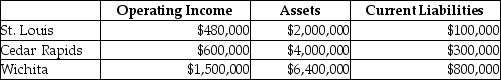

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,400,000 issued at an interest rate of 12%,and equity capital that has a market value of $4,300,000 (book value of $2,100,000) .Waldorf Company has profit centers in the following locations with the following operating incomes,total assets,and current liabilities.The cost of equity capital is 12%,while the tax rate is 35%.

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places. )

Definitions:

Annualized Return

A rate of return that standardizes an investment's earnings to a one-year period, making comparison with other investments easier.

Holding Period

The length of time an investment is held by an investor before being sold.

Riskless Arbitrage

A financial strategy that aims to profit from discrepancies in the price of identical or similar financial instruments on different markets or in different forms without risk.

Spot Oil Prices

The current market price at which oil can be bought or sold for immediate delivery.

Q50: Blistre Company operates on a contribution margin

Q89: All of the following are ways to

Q121: Effort refers to physical exertion,such as a

Q122: Stockout costs arise when an organization experiences

Q122: Which of the following companies will use

Q129: Which of the following statements best defines

Q152: The breakeven point is the activity level

Q161: The controller at TellCo is examining her

Q164: Frazer Corp sells several products.Information of

Q193: How many units would have to be